Occupy the Art World

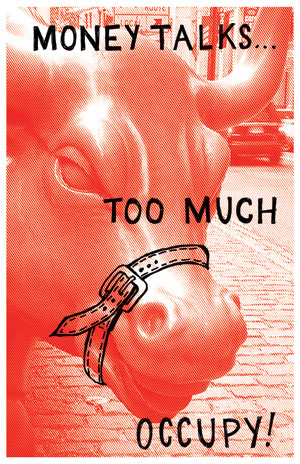

The Occupy Wall Street (OWS) movement describes contemporary U.S. society as being under the domination of the “one percent”, those super-wealthy individuals and corporations that control everything from the media to the halls of Congress.

While the primary focus of OWS has been aimed at the home foreclosures, unemployment, and social inequality fostered by the greed of rapacious banks and corporations, some critical assessment of the impact corporate titans have exercised over culture is also in order.

For those inured to the art world having been commandeered by high finance, now is the time of reckoning. In view of the Occupy movement’s fight against plutocracy, the arts community should scrutinize the role financial institutions have played, and continue to play, in the collapse of the economy. Those same corporations maintain a benevolent public image through funding the arts; I will mention a handful of these oligarchic “arts supporters” in this article.

Mat Gleason, art critic and founder of the Los Angeles arts periodical Coagula Art Journal, wrote an essay for the AOL owned Huffington Post titled, Is Pacific Standard Time Too Big to Fail? While Gleason’s article was certainly a jab at the Getty Foundation’s much heralded Pacific Standard Time extravaganza of some forty exhibits across Southern California, his commentary also raised the issue of corporate sponsorship of the arts. He specifically targeted Bank of America as the financial backer behind Pacific Standard Time. In his article, Gleason wrote:

“A friend sent me her Bank of America ATM receipt with its upbeat encouragement to explore the Pacific Standard Time (PST) website. Could there be a crueler indictment of an art world that is convinced of its moral superiority to mainstream culture than to be subsidized by one of the criminal financial forces that has brought our culture to its very knees?

I was seriously considering a boycott of the entire Pacific Standard Time when I saw an entity sponsoring a cultural event after basically destroying the culture via the economy. For BofA to celebrate the very pulse that it now has contributed to killing is disgusting. But the era of the boycott seems to have vanished – instead of the boycott’s zero attention, the ‘occupy’ era challenges power by giving perpetrators 100 percent attention. While there is a call for people to remove their money from large financial institutions on November 5 and open accounts at a local credit union, how do we as a region remove the art that defines our city and our times from the large art institutions?

I suppose you don’t need an answer to begin your occupation of the art institution of your choice. And if you cannot choose one, don’t forget that the big banks collaborate with art educational institutions to profit mightily off of student loan debt. Curricula in the hallowed halls of these capitalist MFA casinos mimic the self-impressed non-engagement aesthetic as much or more than most PST exhibits. The anxiety is erased into the conceptual ether. Prozac is to art creation what the Getty is to art curation.”

While I do not agree with Gleason’s assessment of the Getty’s Pacific Standard Time exhibitions, his swipe at Bank of America broaches the wider issue of corporate backing of the arts.

The prickly question is, how do artists circumvent the hegemony of the privileged few to establish and sustain truly autonomous art?

In January 2010 the U.S. Supreme Court struck down laws banning corporations from using their vast wealth to support or oppose candidates for political office. Millions of Americans were aghast at the decision, which allows corporations to pump unlimited funds into the coffers of political candidates; a distortion of democracy that gives powerful companies the ability to purchase candidates as well as the legislative process. But if it is injurious to the nation to hand over government to monied interests, then is it not also ruinous to give those same monied elites control over the nation’s artistic and cultural life?

The economic meltdown that began in 2008 was in part a result of corrupt dealings by giant banking and loan companies, particularly in the housing market. As that market collapsed, firms like Bank of America and JPMorgan Chase loaded portfolios with “toxic” mortgage investments, then sold them to unsuspecting clients while betting the investments would fall in value. The scamming was a factor in the economic crisis, yet, as journalist Robert Scheer pointed out, not a single banker faces criminal charges “since the Justice Department has refused to act in these cases, and the Security and Exchange Commission is bringing only civil charges, which the banks find quite tolerable.” By contrast, 4,542 activists have been arrested in protests against the financial elite since the Occupy Wall Street movement began on Sept. 17, 2011.

Throughout the 2004-2008 housing bubble, the banking practices of Bank of America abetted the ’08 crash of the global economy.

In the aftermath of the collapse, BofA received $15 billion in taxpayer’s bailout money from the U.S. government’s Troubled Asset Relief Program (TARP), along with an additional sum of $10 billion so that BofA could purchase the failing bank, Merrill Lynch. In January 2009 BofA received another $20 billion from TARP; unbelievably, 75% of the $20 billion went to pay Merrill Lynch executives massive bonus packages!

Needless to say, the roughly 9 million Americans who lost their jobs as a result of the Wall Street crash have still not received a bailout.

On Sept. 2, 2011, the U.S. Federal Housing Finance Agency (FHFA), announced a lawsuit against more than a dozen major banks, including Bank of America and JPMorgan Chase. The feds charged the banks with having sold some $200 billion in fraudulent mortgage investments to housing giants Fannie Mae and Freddie Mac, leading to huge losses during the financial crisis. On Sept. 13, 2011, CNBC reported that BofA was “ramping up its foreclosure processing, sending out far more notices of default to borrowers in August than in previous months, well over 200 percent more month-to-month.” Around 1.2 million BofA customers in California alone are delinquent in their mortgage payments and could face foreclosure on their homes. When BofA subsidizes a museum or cultural event, one should think of the hundreds of thousands of U.S. citizens the bank has made homeless.

On Nov. 8, 2011, a class-action suit against Bank of America ended with the company being required to pay a $410 million settlement.

The lawsuit affected some 13 million BofA customers who were wrongly charged overdraft fees on their debit cards, charges that were typically $35 per occurrence.

According to the Associated Press, an attorney involved in the lawsuit, “calculated that the bank actually raked in $4.5 billion through the overdraft fees and was repaying less than 10 percent. He said the average customer in the case had $300 in overdraft fees, making them eligible for a $27 award – less than one overdraft charge – from the lawsuit.” With BofA making off with that kind of plunder, no wonder they can afford to underwrite the arts.

Despite being the largest bank in the U.S., BofA paid no income taxes in fiscal years 2009 and 2010. In fact the bank received a tax “benefit” of nearly $1 billion for 2010. The bank’s new CEO, Brian T. Moynihan, received $10 million in 2010 as compensation for his first year as Chief Executive Officer.

With some $2.1 trillion in assets, JPMorgan Chase is the second largest bank after BofA, but it is second to none when it comes to financial crimes – one hardly knows where to begin. As the housing market crashed JPMorgan Chase sold mortgage securities to investors but failed to tell buyers it used a hedge fund to select the assets in the portfolio, and that the hedge fund stood to profit if the investments lost value, which of course they did. More than a dozen investors lost huge sums of money in the crooked deals. JPMorgan Chase paid $153.6 million to settle U.S. Securities and Exchange Commission charges that it had mislead investors.

JPMorgan Chase sponsored The Aztec Pantheon and the Art of Empire, an exhibit that ran from March to July, 2010 at the Getty Villa in Malibu, California. A merger between J.P. Morgan & Co. and Chase Manhattan Bank in 2000 created JPMorgan Chase, but Chase Manhattan Bank has an unsavory history in Latin America. Long associated with the Rockefeller family, Chase was once known for its close ties to Standard Oil (itself founded by John D. Rockefeller), which rapaciously exploited Mexican oil starting in 1910. It is indeed ironic that Chase would be the sponsor of Mexico’s great Aztec art treasures. Chase Manhattan Bank played a key role in the military coup that overthrew Chile’s democratically elected government on September 11, 1973. Christopher Hitchins detailed some of this in his book, The Trial of Henry Kissinger.

The New York Times reported that Jamie Dimon, CEO of JPMorgan Chase, was paid a total of $20,816,289 in 2010, and for the first quarter of 2010 the bank made $3.3 billion in profits. On Nov. 2, 2011, several hundred protestors from the Occupy Seattle movement protested against Dimon when he appeared at the Sheraton Hotel in downtown Seattle, Washington, as a keynote speaker for the University of Washington’s Foster School of Business. Chanting “Banks got bailed out; we got sold out!” the protesters disparaged Dimon for his exorbitant salary, and condemned JPMorgan Chase for getting $25 billion in bailout loans in 2008 while tens of thousands of homeowners lost their homes to foreclosures.

Levi Strauss & Co. (Levi’s®.) and Nike SB (the skateboard division of Nike Inc.) provided financial backing to Art In The Streets, the “blockbuster” exhibit mounted by the Geffen Contemporary at the Museum of Contemporary Art (MOCA), in Los Angeles. Getting uncommon press attention and running from April to August, 2011, the show was the first U.S. museum exhibit to present the history of graffiti and street art.

The exhibit was promoted and generally received as groundbreaking; but consider the following – Levi’s pays Haitian workers slave wages in the sweatshop manufacturing plants the company’s “contractors” operate in Haiti, and Nike does the same in Taiwan where workers are paid 50 cents per hour.

U.S. State Department diplomatic cables obtained by WikiLeaks and published in the Haitian newspaper Haïti Liberté and the monthly Nation magazine, revealed that the Obama White House in 2009 fought to keep the minimum wage in Haiti to just 31 cents an hour so U.S. companies like Levi Strauss could continue to reap vast profits from Haitian workers. The cables reveal that deputy chief of mission at the U.S. Embassy in Port-au-Prince, Haiti, David E. Lindwall, argued that attempts to raise wages “did not take economic reality into account” but were gambits aimed at appealing to “the unemployed and underpaid masses.”

Haiti is the least-developed and poorest country in the Western Hemisphere, and while its workers make pennies a day, Levi Strauss & Co. reported its 2010 net revenues at $4.4 billion. According to documents submitted to the Securities and Exchange Commission, Levi’s CEO Charles “Chip” V. Bergh received compensation of $9,150,000 for fiscal year 2011.

On July 13, 2011, the Associated Press published an exposé on the abysmal conditions workers suffer in Nike’s Asian manufacturing plants, where most of the company’s 1,000 “contractor” run factories are located. The AP noted that 10,000 female workers at the Nike plant in Taiwan make roughly 50 cents per hour, and complain of being physically abused by plant supervisors (enduring kicks, scratches, and slaps), or of being fired for registering complaints. Workers in Nike’s Indonesian plants also spoke of verbal and physical abuse, low wages and arbitrary firings.

After the AP released its findings, Nike promised “immediate and decisive action” to end the abuses, but it made the same claims in decades past when caught using child labor in Indonesia and Cambodia (involving girls as young as twelve who worked for 22 cents an hour, seven days a week, for sixteen hours a day). It should be noted that while Nike’s contract workers in Asia today are paid around 50 cents an hour, the company earned $1.91 billion in fiscal year 2010, and its CEO, Mark Parker, received $13.1 million in compensation. If the aforementioned facts about the sponsors of Art In The Streets had been known, visitors to the exhibit might have been offended; but corporate sponsorship of the arts, at least from the perspective of corporations, is an effective way to conjure up a benevolent public image where otherwise one does not exist.

Target subsidizes free admission days at more than 30 U.S. museums and theaters, from the Los Angeles County Museum of Art (LACMA) to the Museum of Modern Art in New York City. But the mega-box store is not without its controversies, from telling its pharmacists they can refuse dispensing emergency contraception to customers, to contributing money to anti-gay groups and politicians. Those enjoying their free museum admission days might be surprised to learn that Target was the number one contributor to Republican Congresswoman and Tea Party favorite, Michele Bachmann, donating $19,950 to the candidate’s 2009-2010 campaign.

In fiscal year 2010 Target made over $67 billion and Gregg Steinhafel, Chairman, President and CEO of Target Stores Inc., received compensation of $24 million. Yet, Target’s mostly part-time workers earn “too little to support a family or afford health insurance, forcing some to rely on food stamps and Medicaid for their children”, according to a New York Times report.

Target’s workers are entirely non-unionized. New hires are required to watch an anti-union propaganda video that is positively Orwellian. A campaign to unionize the Valley Stream, New York Target store faced intimidation and harassment.

The union lost the June 2011 election, but the National Labor Relations Board found evidence that Target threatened workers with the store’s closure if they voted union, a violation of labor laws that may lead to nullification of the election results.

I have been writing about the relationship between BP (British Petroleum, one of the world’s biggest polluters), and the Los Angeles County Museum of Art (LACMA) since March of 2007. In fact this web log was the first to offer a critique of LACMA’s association with BP. My archive of articles pertaining to the BP-LACMA arrangement makes for interesting reading, though there is always something new to report, such as the following.

On Nov. 5, 2011, the Guardian reported that court documents revealed BP’s business dealings with the Russian government and oil consortiums caused BP to describe their Russian contacts as “crooks and thugs.” Whether or not the Russians BP deals with are criminal types is beside the point; that BP perceives them to be gangsters and yet continues to partner with them tells everything there is to know about the business ethos of BP. A review of BP’s multi-billion dollar dealings with Libya’s former strongman Muammar Gaddafi only sharpens the point.

Project Censored released a report in 2011 claiming the U.S. Department of Defense is the worst polluter on the planet. Whether or not readers accept those allegations, BP selling huge amounts of aviation fuel and petroleum products to the Pentagon cannot be disputed. The Washington Post reported that BP “was the Pentagon’s largest single supplier of fuel” in 2009, and that “contracts amount to roughly the same percentage” for 2010. Sales continued even as BP’s pipeline gushed tens of millions of gallons of oil into the Gulf of Mexico. The paper quoted a former EPA lawyer familiar with the contract between BP and the Pentagon: “BP was supplying approximately 80 percent of the fuel being used to move U.S. forces” in the Middle East.

We have entered the age of austerity, and everywhere the 99% are being made to pay for the financial crimes of the 1%. Those who say corporate backing of the arts is necessary, that museums and other cultural venues could not survive without it, especially with austerity budgets and deep cuts in arts funding being enacted by governments, are missing an essential fact. The resources exist, they are simply monopolized by a minority out of greed and self-interest. The Congressional Budget Office reported that from 1979 to 2007 the after-tax income of America’s top 1 percent soared 275 percent. More importantly, Citizens for Tax Justice released a report showing that 280 of the most profitable U.S. corporations have sheltered half their profits from taxes, and thirty U.S. corporations paid no federal income tax whatsoever from 2008 to 2010. In addition, the report found that “the top ten defense contractors saw their combined tax rate decline from 19.3 percent in 2008 to a mere 10.6 percent in 2010”.